Trust Foundations: Making Certain Toughness and Reliability

Trust Foundations: Making Certain Toughness and Reliability

Blog Article

Reinforce Your Legacy With Specialist Depend On Structure Solutions

Specialist depend on foundation options offer a durable framework that can safeguard your properties and guarantee your desires are carried out exactly as planned. As we dig right into the nuances of depend on structure solutions, we discover the essential components that can strengthen your heritage and offer a lasting influence for generations to come.

Benefits of Trust Foundation Solutions

Count on structure solutions use a durable framework for safeguarding possessions and ensuring lasting financial security for individuals and organizations alike. One of the primary benefits of trust fund foundation solutions is property defense. By developing a trust fund, people can shield their properties from potential dangers such as legal actions, financial institutions, or unanticipated monetary responsibilities. This security guarantees that the assets held within the trust stay safe and secure and can be handed down to future generations according to the person's desires.

With depends on, individuals can describe just how their assets need to be handled and dispersed upon their death. Trusts additionally use personal privacy benefits, as possessions held within a depend on are not subject to probate, which is a public and frequently extensive legal process.

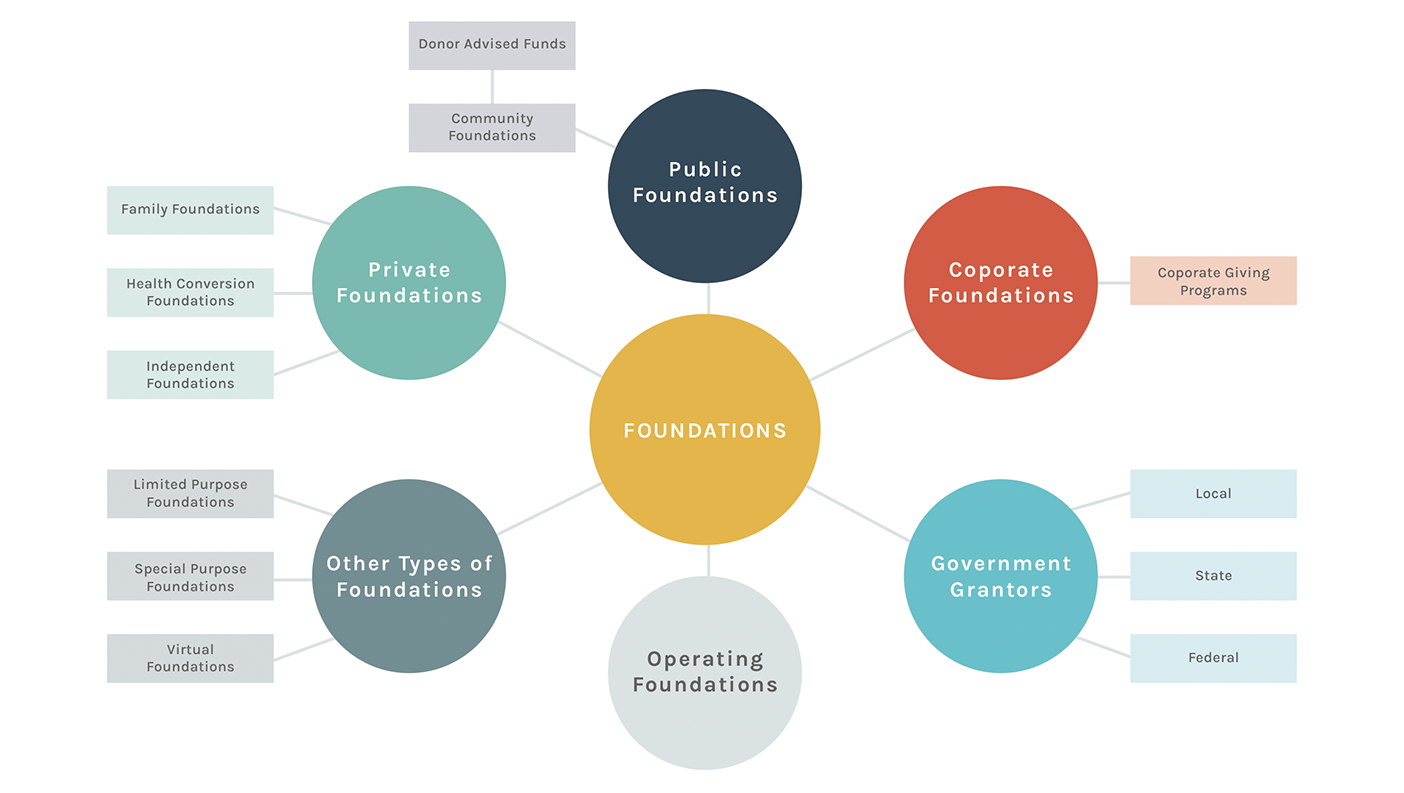

Kinds of Trusts for Heritage Planning

When thinking about heritage planning, an important aspect involves discovering different types of lawful tools created to maintain and distribute possessions successfully. One typical kind of trust fund used in heritage preparation is a revocable living trust. This trust permits people to preserve control over their possessions during their lifetime while ensuring a smooth shift of these assets to beneficiaries upon their passing away, preventing the probate process and providing personal privacy to the household.

An additional kind is an irreversible trust fund, which can not be altered or revoked once established. This count on supplies potential tax benefits and shields assets from financial institutions. Philanthropic counts on are likewise preferred for people looking to support a reason while keeping a stream of revenue on their own or their beneficiaries. Unique demands trust funds are necessary for people with disabilities to ensure they receive needed care and support without threatening government advantages.

Understanding the different sorts of counts on offered for tradition preparation is important in developing a detailed approach that aligns with individual objectives and priorities.

Choosing the Right Trustee

In the world of legacy planning, an essential facet that demands cautious consideration is the selection of an ideal person to meet the crucial role of trustee. Selecting the best trustee is a choice that can dramatically impact the effective execution of a trust fund and the fulfillment of the grantor's dreams. When selecting a trustee, it is important to focus on qualities such as dependability, financial acumen, honesty, and a commitment to acting in the very best interests of click for more info the beneficiaries.

Preferably, the selected trustee ought to possess a solid understanding of economic this post issues, can making audio financial investment decisions, and have the ability to navigate complicated legal and tax demands. Additionally, effective interaction abilities, interest to information, and a determination to act impartially are also essential characteristics for a trustee to possess. It is a good idea to select a person who is trustworthy, liable, and capable of satisfying the obligations and obligations associated with the duty of trustee. By carefully taking into consideration these variables and choosing a trustee that straightens with the values and goals of the trust, you can assist ensure the long-lasting success and preservation of your legacy.

Tax Implications and Advantages

Thinking about the monetary landscape surrounding depend on structures and estate planning, it is extremely important to look into the detailed world of tax obligation ramifications and advantages - trust foundations. When developing a count on, comprehending the tax ramifications is essential for enhancing the advantages and minimizing potential liabilities. Trusts use numerous tax obligation benefits relying on their structure and purpose, such as decreasing inheritance tax, income taxes, and present taxes

One considerable advantage of certain trust frameworks is the ability to move possessions to recipients with minimized tax effects. For instance, irreversible trust funds can remove assets from the grantor's estate, potentially reducing inheritance tax liability. In addition, some trust funds enable for income to be dispersed to recipients, that may be in lower tax braces, leading to total tax obligation savings for the family.

Nevertheless, it is very important to keep in mind that tax laws are complex and conditional, emphasizing the necessity of seeking advice from tax experts and estate planning experts to ensure conformity and take full advantage of the tax obligation advantages of count on structures. Correctly browsing the tax implications of trust funds can cause considerable cost savings and a more efficient transfer of wealth to future generations.

Actions to Establishing a Trust Fund

The initial step in establishing a count on is to plainly define the purpose of the depend on and the possessions that will certainly be consisted of. Next off, it is essential to pick the type of depend on that ideal lines up with your goals, whether it be a revocable depend on, irrevocable trust you can try these out fund, or living depend on.

:max_bytes(150000):strip_icc()/land-trust.asp-final-62434e1dd78a4eaaae6b6b3a531c82a2.png)

Final Thought

Finally, establishing a trust structure can offer various advantages for heritage preparation, including asset security, control over circulation, and tax obligation advantages. By choosing the suitable type of trust and trustee, individuals can guard their assets and guarantee their desires are performed according to their needs. Recognizing the tax implications and taking the necessary actions to establish a trust fund can assist strengthen your heritage for future generations.

Report this page